Is directors medical expense tax. Accrual of director fee since 2019 RM150000.

2021 Tax Return With Zero Income In 2022

In general medical fee for the employee is tax-deductible under S 33 of the Income Tax Act 1967.

. Any course of study undertaken for the purpose of up-skilling or self-enhancement recognized by the Director General of Skills Development under the National Skills Development Act 2006. Directors Remuneration and Tax Planning- Evidence from Malaysia. KTP Company PLT AF1308 LLP0002159-LCA In general medical fee on.

Medical bills rent and shares. And deduct and remit the Monthly Tax Deduction PCB to the IRBM by 15 Jan 2020. In general medical fee for the employee is tax-deductible under S 33 of the Income Tax Act 1967.

After all the limited company is the employer and the director is the employee. KTP Company PLT AF1308 LLP0002159-LCA Can directors medical fee tax deductible in Sdn Bhd. Is directors medical expense tax-deductible in Malaysia.

Generally an expenditure is not tax deductible if. Is directors medical expense tax-deductible in Malaysia. TARIKH KEMASKINI 06062021 03-8911 1000 Hasil Care Line 03-8751 1000 Hasil Recovery Call Centre LhdnTube LHDNMofficial LHDNM LHDNM wwwhasilgovmy.

If you want to claim your medical fee in ABC Sdn Bhd as deductible. Private expense Pre-commencement expenditure. In general medical fee for the employee is tax-deductible under S 33 of the Income Tax Act 1967.

THK Management Advisory Sdn Bhd - Medical Fee on director is a tax exempted BIK. Updated guidance addresses the taxation of professional services and. By Compiled LISA GOH.

Sunday 29 Apr 2012. Accrual of director fee since 2018 RM100000. Telcos 22 Jul 2022.

VICTOR CHOONG must report this director fee income in respect of year 2019 in his. Not wholly and exclusively incurred for the purpose of business eg. Director medical fees tax deductible malaysia.

Directors Remuneration and Tax Planning- Evidence from Malaysia. Updated guidance on taxation of professional services directors fees. THK Management Advisory Sdn Bhd - Medical Fee on director is a tax exempted BIK.

- Feb 19 2021 Johor Bahru JB Malaysia Taman Molek Service THK Management. Given 2 Director of Kena Tax Sdn. Currently expenses incurred on secretarial and tax filing fees are given a tax deduction of up to RM5000 and RM10000 respectively for each year of assessment YA.

- Feb 19 2021 Johor Bahru JB Malaysia Taman Molek Service THK Management Advisory - Our. Can directors medical fee tax deductible in Sdn Bhd. By Thursday 12 January 2017 Published in Tax Planning.

If you are an employee they are not deductible. Additional deduction of MYR 1000 for YA 2020 to 2023 increased maximum to MYR 3000. Special relief for domestic travelling expenses until YA 2022.

Say your are major shareholder cum director in ABC Sdn Bhd. As a forensic accountant I acted as expert witnes on a couple of cases for insurance companies. Accrual of director fee since 2020 RM200000.

By Thursday 12 January 2017. The membership subscription paid to professional bodies for ones profession like medical or legal professional fees can.

Heather Bonsell Transfer Pricing Manager John Deere Linkedin

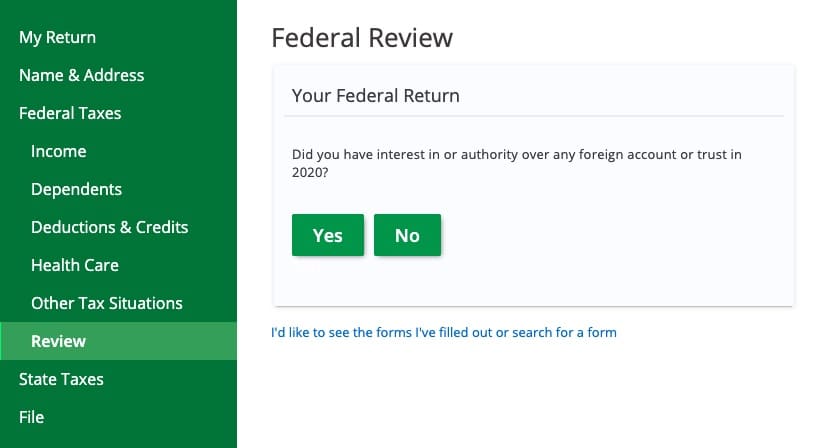

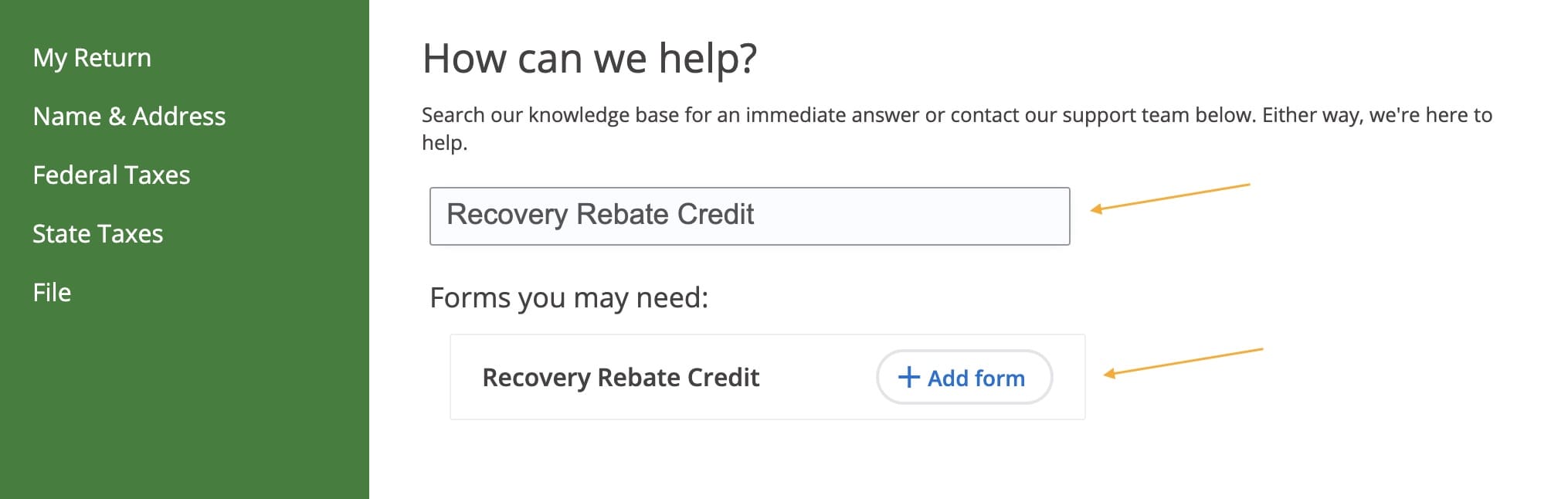

2021 Tax Return With Zero Income In 2022

12 Ways To Beat Capital Gains Tax In The Age Of Trump

We Are Hiring Operations Management Recruitment Agencies Job Hunting

5 Difference Between Elss Vs Ppf Vs Nsc Vs Tax Saving Fixed Deposit Nri Saving And Investment Tips Savings And Investment Income Tax Tax Free Savings

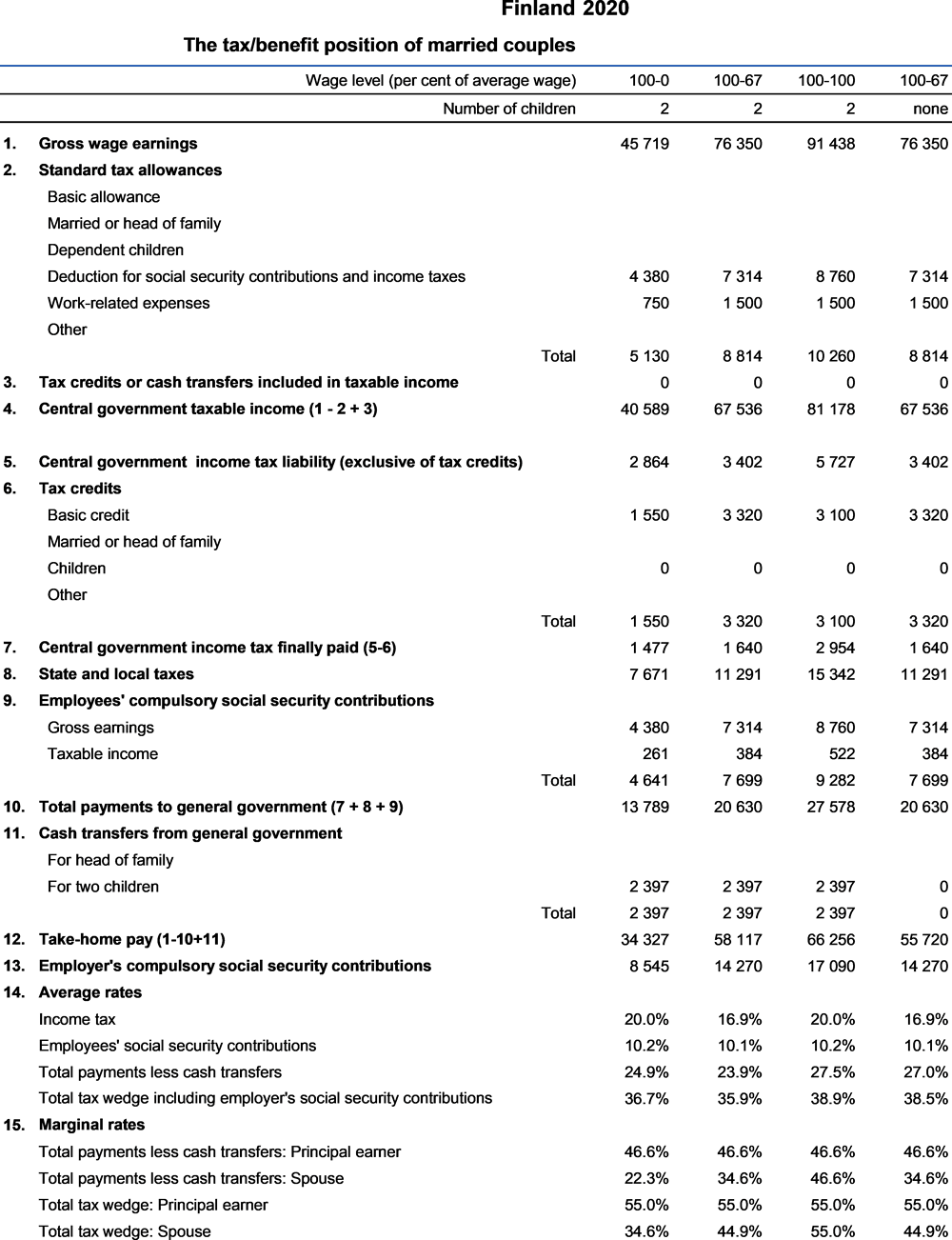

Finland Taxing Wages 2021 Oecd Ilibrary

Taxable Income Formula Examples How To Calculate Taxable Income

Making Machine 30000pcs In Stock Medical Gown Protective Uniforms Making Machine Making Glass Enigma Machine

Surveyed Tax Pros Pessimistic On Changes Grant Thornton

25 Tax Deductions Your Business Doesn T Know About Due

Updated Guide On Donations And Gifts Tax Deductions

Hill Democrats Shift From Raising To Cutting Taxes On The Merely Rich

Corporate Income Tax Deductibility Of Expenses Youtube

Updated Guide On Donations And Gifts Tax Deductions

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

North Carolina Providing Broad Based Tax Relief Grant Thornton

Tax Write Offs For Athletes Awm Capital Awm Capital

Image Result For Malaysia Simplify Membership Form Format In Word Signs Youre In Love Words Free Business Card Design